Electrical Test and Tag Service for Protecting Lives and Property Melbourne

In today’s modern world, electricity plays a crucial role in our daily lives. We rely on it for lighting, heating, cooling, cooking, and powering our electronic devices. However, if not properly maintained, electrical systems can pose serious risks to both lives and property. This is where electrical test and tag services come into play.

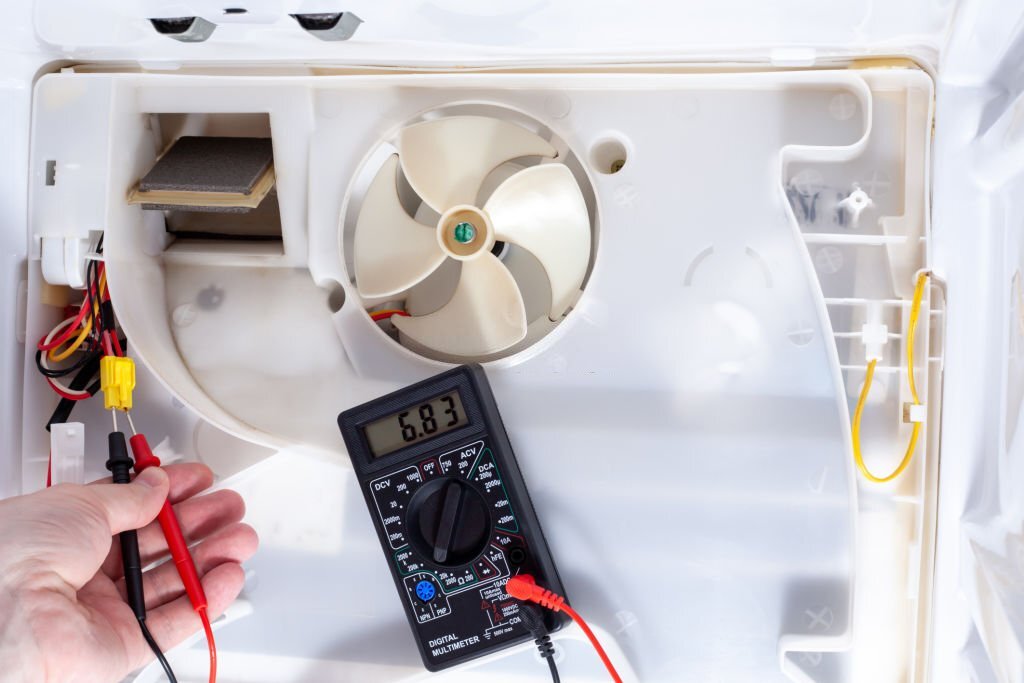

Electrical test and tag services involve inspecting and testing electrical equipment to ensure that it is safe to use. This process involves a series of tests, including visual reviews, electrical testing, and tagging. Electrical hazards can be identified and addressed by conducting these tests before they lead to accidents or damage.

One of the main reasons electrical test and tag services are essential for protecting lives is the prevention of electrical fires. Faulty electrical equipment or wiring can cause sparks or overheating, igniting flammable materials. Electrical fires can spread rapidly and cause extensive damage to buildings and properties. Regularly testing and tagging electrical equipment can identify and rectify potential fire hazards, significantly reducing the risk of fire incidents.

Another critical aspect of electrical test and tag services is the prevention of electric shocks. Electrical shocks occur when a person comes into contact with an energized electrical source. This can happen due to faulty wiring, damaged plugs, or defective electrical equipment. Electric shocks can range from mild to severe, depending on the voltage and duration of exposure. In severe cases, electric shocks can lead to serious injuries or even death. Conducting electrical tests can identify potential electrical faults, and necessary repairs or replacements can be made to prevent electric shocks.

Electrical test and tag services also play a vital role in workplace safety. Many workplaces rely heavily on electrical equipment, such as power tools, machinery, and appliances. Regular testing and tagging of this equipment ensure that it meets safety standards and is safe for use by employees. Maintaining a safe working environment can significantly reduce the risk of accidents and injuries.

Furthermore, electrical test and tag services help comply with legal and regulatory requirements. In many countries, electrical safety standards and regulations exist to protect the welfare of individuals and properties. Failure to comply with these standards can result in penalties, fines, or legal actions. By regularly testing and tagging electrical equipment, businesses can demonstrate their commitment to safety and ensure compliance with these regulations.

In addition to protecting lives, electrical test and tag services also help prevent property damage. Electrical faults can lead to short circuits, power surges, or electrical overloads, which can damage electrical appliances, electronic devices, and even the electrical infrastructure of a building. Property damage can be minimized by identifying and rectifying potential faults through testing, saving businesses and individuals from substantial financial losses.

In conclusion, electrical test and tag services are crucial for protecting lives and property. Regular inspections and tests allow electrical hazards to be identified and addressed before they lead to accidents or damage. These services are vital in preventing electrical fires, electric shocks, workplace accidents, and property damage. They also help businesses comply with legal requirements and demonstrate their commitment to safety. Investing in electrical test and tag services is a proactive approach to ensuring the safety of individuals and properties, and it is an essential step in today’s electrical-dependent world.